Eddie-Griffin

Banned

https://www.counterpointresearch.com/1-million-xr-headsets-shipped-china-2022-pico-number-1/

Pico and two others, (Iqiyi and YVR which would be under other) will be releasing in the US and/or west at some point this year 2023. DPVR is already currently shipping out their E4 headset. HTC of course just came out with their XR Elite.

But all 4 cost/will cost between $400-$500 which will put Zucker into the middle of sudden competition. All 4 of them also have their own ecosystems with their own software so not just rising off other stores.

Going by the 1.1 million sales, based on the percentages the standings look something like this,

That's a pretty balanced (relative to the US right now) distribution for the market size.

With 3 of these guys releasing headsets in the US and elsewhere this year, and DPVR already now shipping, Quest isn't going to be alone in the lower-priced sector this time.

Of course, Domestic performance won't show how they will do int he US, we will have to see what games they translate and what features they bring over and their marketing. Not to mention there's like 300 other headsets coming out as well this year.

2023 is going to be a very crowded but exciting time in VR.

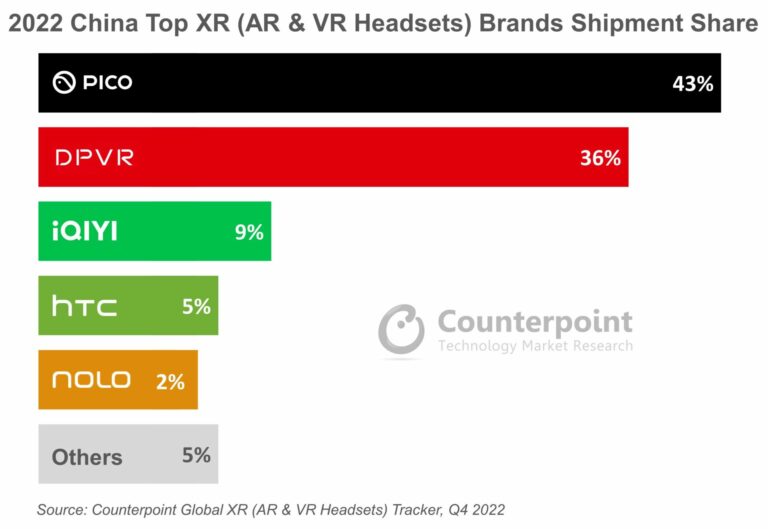

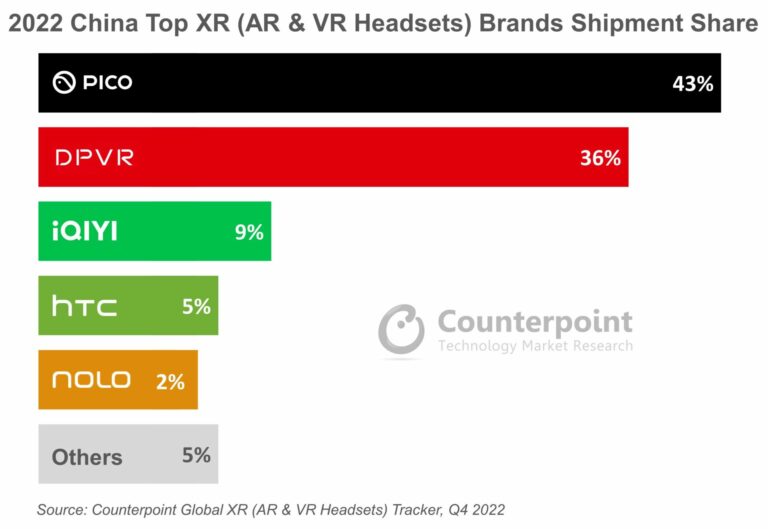

Extended Reality [XR: Augmented Reality (AR) and Virtual Reality (VR) headsets] shipments crossed 1.1 million units in China in 2022 according to Counterpoint Research’s XR Model Tracker. VR remains the dominant segment within XR, contributing more than 95% to overall shipments in 2022. The Chinese market has considerable untapped potential but is growing slowly because available headsets do not offer enough value in the consumer domain for mass consumption.

While the consumer segment did not see a major shift, volume growth was produced by enterprise deals, mostly in the education and training sectors. The potential for further volume growth is limited in the enterprise segment which remains niche as the currently available headsets are not yet advanced enough to offer enticing use cases. So, brands have started to focus more on the consumer segment, particularly gaming. However, Chinese brands are offering few and mostly simple VR games. Brands must develop high-quality games to increase consumer traction.

Pico is the number one brand in China’s XR market with a shipment share of 43% in 2022, followed by DPVR at 36%. iQIYI, HTC and NOLO, each of which captured a single-digit share, also made it to the top five.

Pico, since its acquisition by TikTok’s parent, ByteDance, has gained greater global as well as local prominence. The additional financial, human and soft resources that ByteDance is pouring into Pico helped it to become a major player. Since the acquisition, Pico’s strategy has been to establish itself as a major player in the consumer XR segment. For this, it has priced its recent Pico 4 headset at close to $400, similar to Meta’s Quest 2.

DPVR shipped the next highest number of XR headsets in China and is the biggest player in the enterprise segment. Existing partnerships and growing regional prominence will ensure a healthy growth rate for DPVR, but it has a limited opportunity for volume growth in the enterprise segment. It is therefore betting big on its E4 gaming headset.

iQIYI, with a focus on VR content and streaming, took the third spot on the list while HTC’s volumes continued to be driven by Vive Flow. However, HTC is facing difficulty to sell its headsets owing to their high price points. NOLO also made it to the top five list thanks to its consumer-grade headsets targeted at gamers.

Pico and two others, (Iqiyi and YVR which would be under other) will be releasing in the US and/or west at some point this year 2023. DPVR is already currently shipping out their E4 headset. HTC of course just came out with their XR Elite.

But all 4 cost/will cost between $400-$500 which will put Zucker into the middle of sudden competition. All 4 of them also have their own ecosystems with their own software so not just rising off other stores.

Going by the 1.1 million sales, based on the percentages the standings look something like this,

| Pico | 473k |

| DPVR | 396k |

| IQIYI | 99k |

| HTC | 55k |

That's a pretty balanced (relative to the US right now) distribution for the market size.

With 3 of these guys releasing headsets in the US and elsewhere this year, and DPVR already now shipping, Quest isn't going to be alone in the lower-priced sector this time.

Of course, Domestic performance won't show how they will do int he US, we will have to see what games they translate and what features they bring over and their marketing. Not to mention there's like 300 other headsets coming out as well this year.

2023 is going to be a very crowded but exciting time in VR.