Luminoth-4545

Member

Credit: Welfare from InstallBase

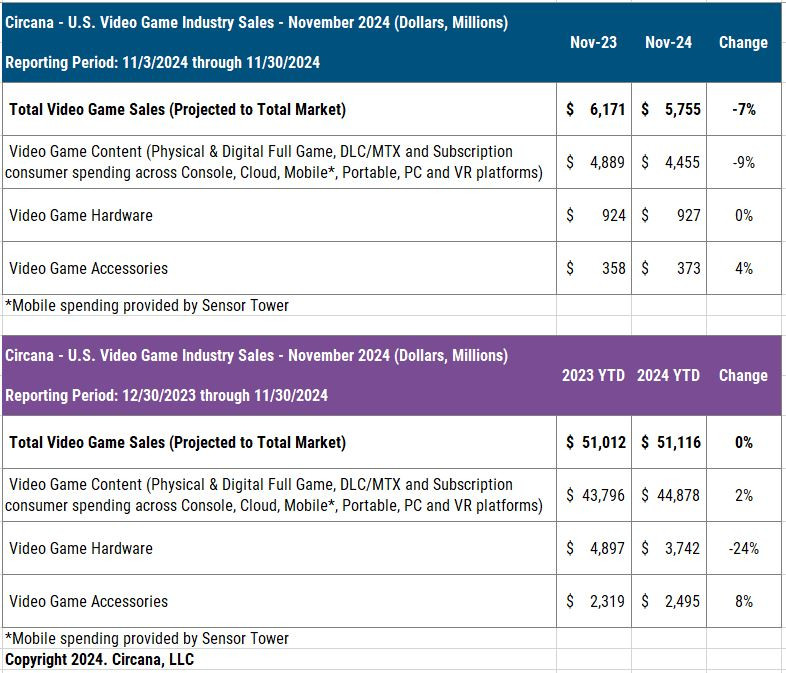

State of the market

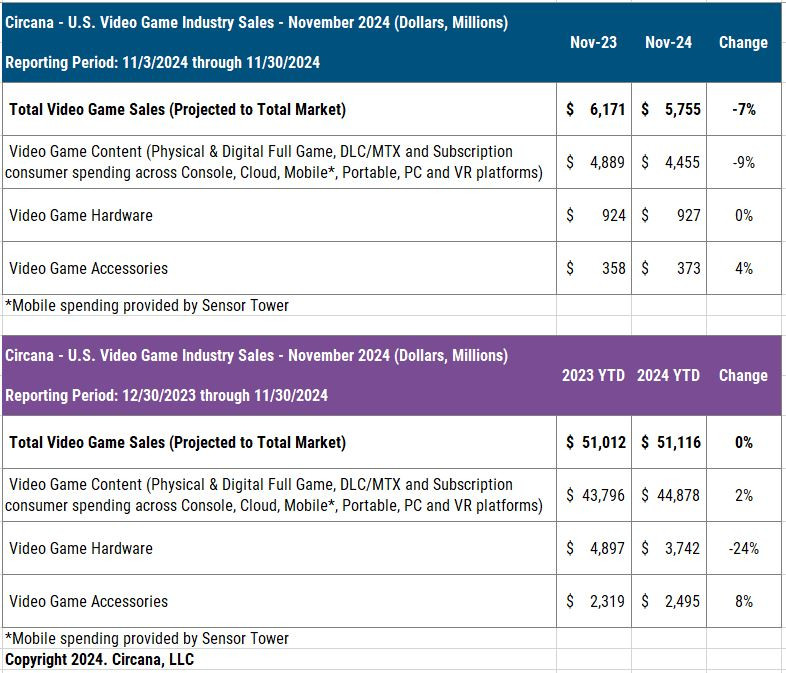

Projected November 2024 U.S. consumer spending on video game hardware, content and accessories fell 7% when compared to a year ago, to $5.8 billion. Year-to-date spending is flat to last year. Video game content spending dropped 9% versus a year ago, to $4.5 billion. Growth in mobile and non-mobile subscription content spending was offset by dips across other areas of content. Console content spending was the biggest contributor to the decline, falling 29% vs YA.

Non-mobile video game subscription spending grew 8% when compared to a year ago. The release of Call of Duty: Black Ops 6 as part of Xbox Game Pass was again the primary growth driver.

Hardware

November video game hardware spending was flat when compared to a year ago, at $927 million. 15% spending growth on PlayStation 5 hardware was offset by a 29% year-on-year drop in Xbox Series spending and a 3% decline in Switch.

Lifetime unit sales of Nintendo Switch have now exceeded those of PlayStation 2 in the U.S. market. With its 46.6 million units sold life-to-date, Switch now ranks 2nd in all-time units sold across all video game hardware platforms in the U.S., trailing only Nintendo DS.

PlayStation 5 Pro accounted for 19% of total PlayStation 5 units sold in the month and 28% of dollars. Launch month dollar sales of PlayStation 5 Pro were more than 50% higher than the November 2016 launch month sales of PlayStation 4 Pro, while units were 12% lower. PlayStation 5 was once again the best-selling hardware platform in both unit and dollar sales for the month, with Nintendo Switch ranking 2nd across both measures.

2.4M units of new video game hardware sold in November 2024 across all platforms, 4% higher than the 2.3M units sold a year ago. For the 2024 year-to-date period ending November, hardware unit sales reached 9.4M units, down from the 11.8M units sold in the same period a year ago.

Software

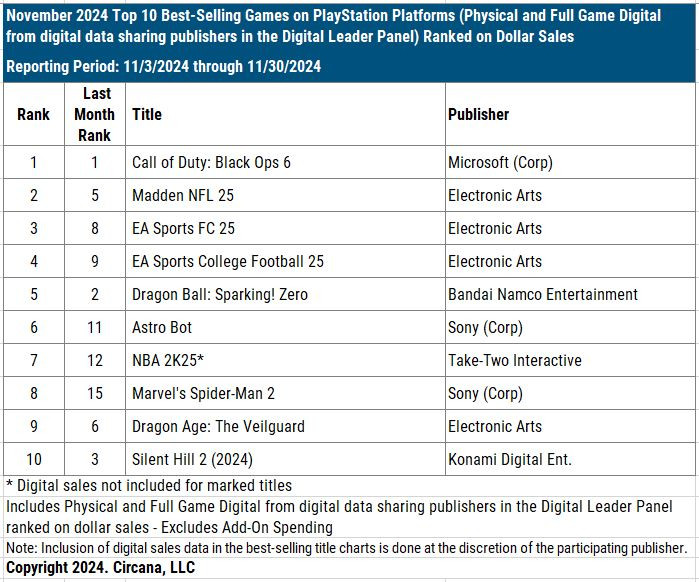

EA Sports College Football 25 became the best-selling Sports video game in U.S. history (dollar sales) and now ranks among the top 50 best-selling tracked video games all-time in that measure.

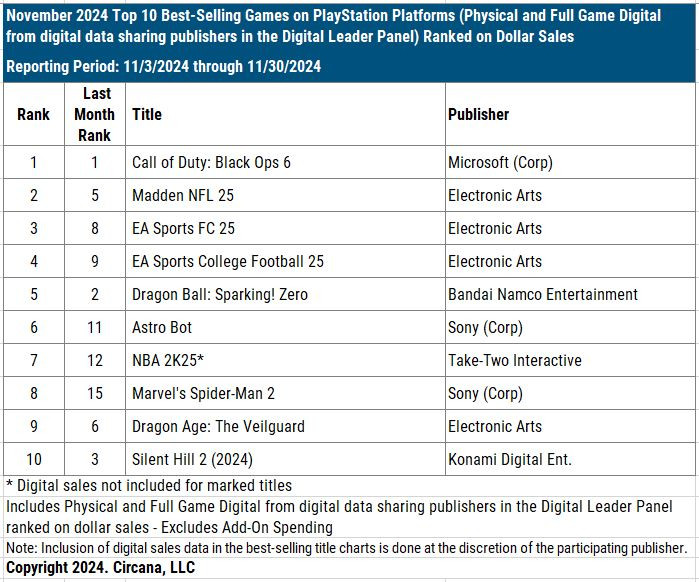

Price promotion helped several titles gain in the November sales rankings when compared to October, including Madden NFL 25 (#2), EA Sports FC 25 (#3), and Marvel's Spider-Man 2 (#14), among others.

Mobile

Sensor Tower: Top 10 mobile games by U.S. consumer spend in November and rank change vs October: MONOPOLY GO!, Royal Match, Roblox, Candy Crush Saga, Last War: Survival, Pokémon TCG Pocket (NEW), Whiteout Survival (-1), Township (-1), Coin Master (-1), and Brawl Stars.

"The story for November is without a doubt the launch of Pokémon TCG Pocket. The game launched in late October and is the #2 game by revenue worldwide for November 2024, beating out Royal Match and MONOPOLY GO!," said Samuel Aune of Sensor Tower. "Pokémon TCG Pocket is without a doubt the biggest launch of 2024. A great deal of success can be attributed to the power of the Pokémon IP and its obvious synergy with a mobile card game, but much of its success is undoubtedly execution that competitors can learn from." - Aune

Accessories

Consumer spending on Accessories increased 4% in November when compared to a year ago, to $373 million. An 8% increase in Gamepad spending drove the growth.

The PS5 Dual Sense Wireless Controller Midnight Black was the best-selling Gamepad in dollar sales for both November and 2024 year-to-date, with PlayStation Portal remaining the best-selling accessory overall in dollar sales over both periods.

Software Charts

Year to Date

Playstation

Xbox

Nintendo

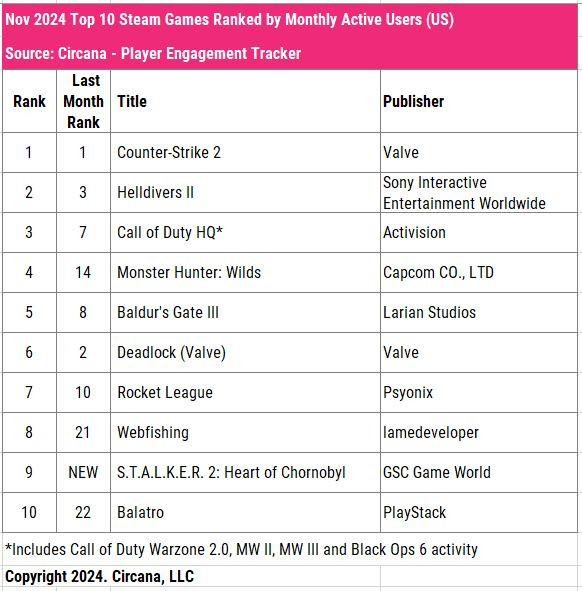

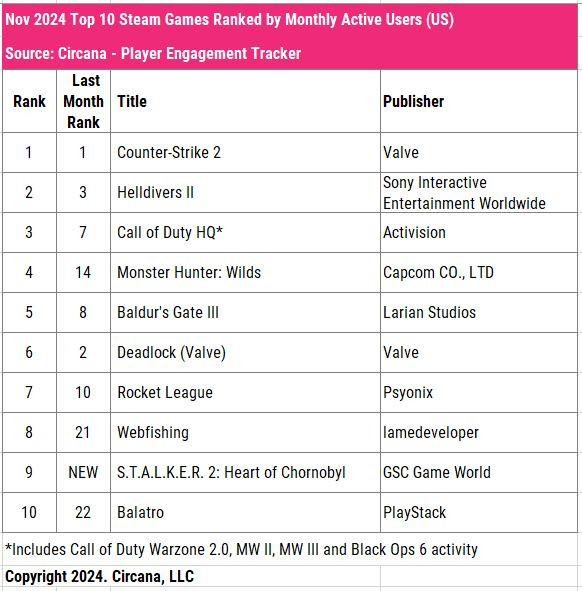

Monthly Active User Engagement

Rankings

Units: PS5 > NSW > XBS

Revenue: PS5 > NSW > XBS

Unit sales (estimates)

PS5: 1220K

NSW: 620K

XBS: 430K

Thanks Mat Piscatella!

State of the market

Projected November 2024 U.S. consumer spending on video game hardware, content and accessories fell 7% when compared to a year ago, to $5.8 billion. Year-to-date spending is flat to last year. Video game content spending dropped 9% versus a year ago, to $4.5 billion. Growth in mobile and non-mobile subscription content spending was offset by dips across other areas of content. Console content spending was the biggest contributor to the decline, falling 29% vs YA.

Non-mobile video game subscription spending grew 8% when compared to a year ago. The release of Call of Duty: Black Ops 6 as part of Xbox Game Pass was again the primary growth driver.

Hardware

November video game hardware spending was flat when compared to a year ago, at $927 million. 15% spending growth on PlayStation 5 hardware was offset by a 29% year-on-year drop in Xbox Series spending and a 3% decline in Switch.

Lifetime unit sales of Nintendo Switch have now exceeded those of PlayStation 2 in the U.S. market. With its 46.6 million units sold life-to-date, Switch now ranks 2nd in all-time units sold across all video game hardware platforms in the U.S., trailing only Nintendo DS.

PlayStation 5 Pro accounted for 19% of total PlayStation 5 units sold in the month and 28% of dollars. Launch month dollar sales of PlayStation 5 Pro were more than 50% higher than the November 2016 launch month sales of PlayStation 4 Pro, while units were 12% lower. PlayStation 5 was once again the best-selling hardware platform in both unit and dollar sales for the month, with Nintendo Switch ranking 2nd across both measures.

2.4M units of new video game hardware sold in November 2024 across all platforms, 4% higher than the 2.3M units sold a year ago. For the 2024 year-to-date period ending November, hardware unit sales reached 9.4M units, down from the 11.8M units sold in the same period a year ago.

Software

EA Sports College Football 25 became the best-selling Sports video game in U.S. history (dollar sales) and now ranks among the top 50 best-selling tracked video games all-time in that measure.

Price promotion helped several titles gain in the November sales rankings when compared to October, including Madden NFL 25 (#2), EA Sports FC 25 (#3), and Marvel's Spider-Man 2 (#14), among others.

Mobile

Sensor Tower: Top 10 mobile games by U.S. consumer spend in November and rank change vs October: MONOPOLY GO!, Royal Match, Roblox, Candy Crush Saga, Last War: Survival, Pokémon TCG Pocket (NEW), Whiteout Survival (-1), Township (-1), Coin Master (-1), and Brawl Stars.

"The story for November is without a doubt the launch of Pokémon TCG Pocket. The game launched in late October and is the #2 game by revenue worldwide for November 2024, beating out Royal Match and MONOPOLY GO!," said Samuel Aune of Sensor Tower. "Pokémon TCG Pocket is without a doubt the biggest launch of 2024. A great deal of success can be attributed to the power of the Pokémon IP and its obvious synergy with a mobile card game, but much of its success is undoubtedly execution that competitors can learn from." - Aune

Accessories

Consumer spending on Accessories increased 4% in November when compared to a year ago, to $373 million. An 8% increase in Gamepad spending drove the growth.

The PS5 Dual Sense Wireless Controller Midnight Black was the best-selling Gamepad in dollar sales for both November and 2024 year-to-date, with PlayStation Portal remaining the best-selling accessory overall in dollar sales over both periods.

Software Charts

Year to Date

Playstation

Xbox

Nintendo

Monthly Active User Engagement

Rankings

Units: PS5 > NSW > XBS

Revenue: PS5 > NSW > XBS

Unit sales (estimates)

PS5: 1220K

NSW: 620K

XBS: 430K

Thanks Mat Piscatella!

Last edited: