Thick Thighs Save Lives

NeoGAF's Physical Games Advocate Extraordinaire

State of the market

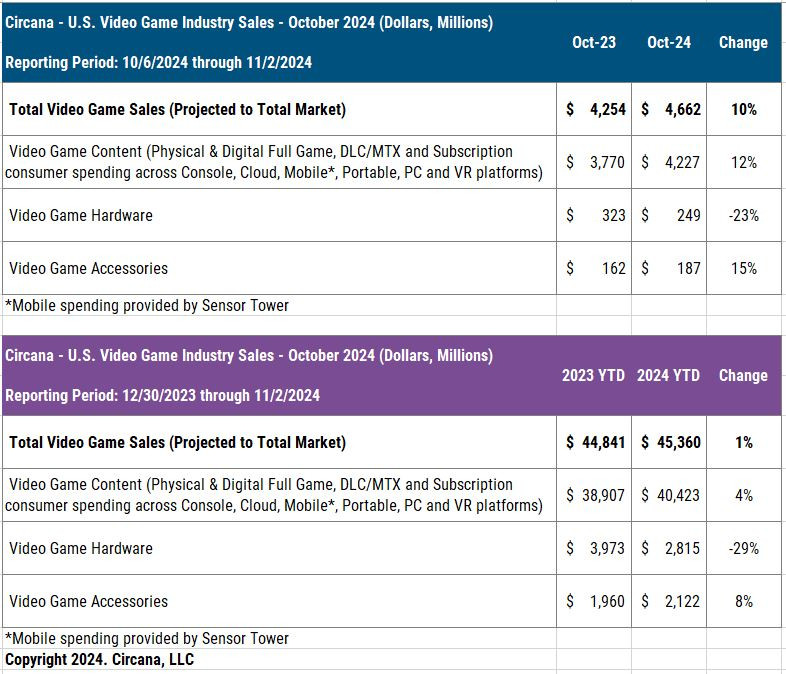

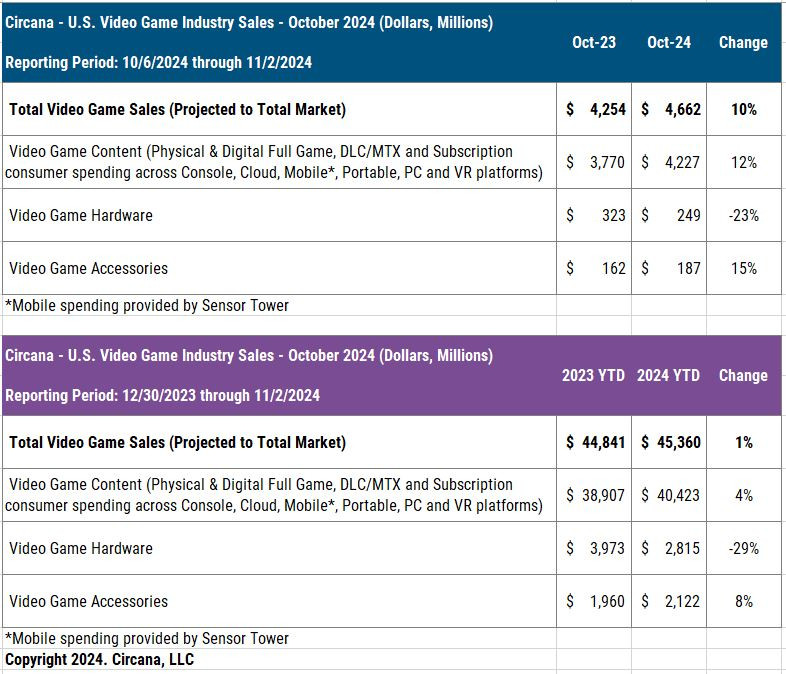

Projected October 2024 total U.S. spending on video game hardware, content and accessories grew 10% when compared to a year ago, to $4.7 billion. Year-to-date spending is now 1% above a year ago, at $45.4 billion.

Video game content spending increased by 12% versus a year ago, reaching $4.2 billion. Console content was the biggest contributor to the overall gain, with a spending increase of 27% when compared to a year ago, fueled by console digital full game sales. Non-mobile video game subscription spending increased by 16% when compared to a year ago. The release of Call of Duty: Black Ops 6 as part of Xbox Game Pass was the primary growth driver.

Hardware

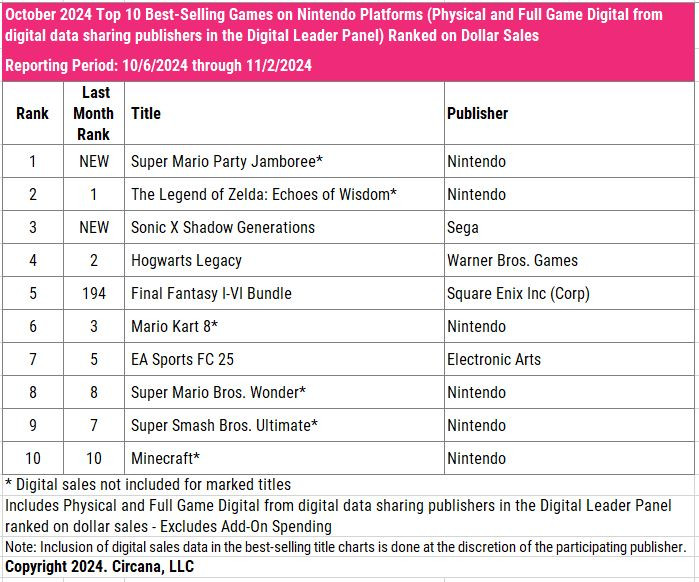

Video game hardware spending dropped 23% in October when compared to a year ago. Switch dollar sales fell 38% year-on-year during October, while PS5 declined by 20% and Xbox Series showed an 18% decrease.

PlayStation 5 was once again the best-selling hardware platform in both unit and dollar sales for the month, with Xbox Series ranking 2nd across both measures.

604k units of new video game hardware sold in October 2024 across Arcade, Nintendo Switch, PlayStation 4, PlayStation 5, Plug-N-Play, and Xbox Series platforms. This is down from the 759k units sold a year ago.

Software

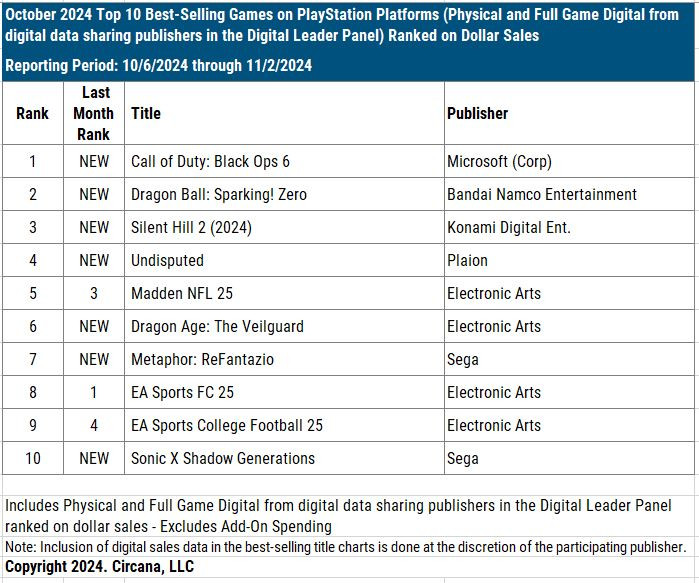

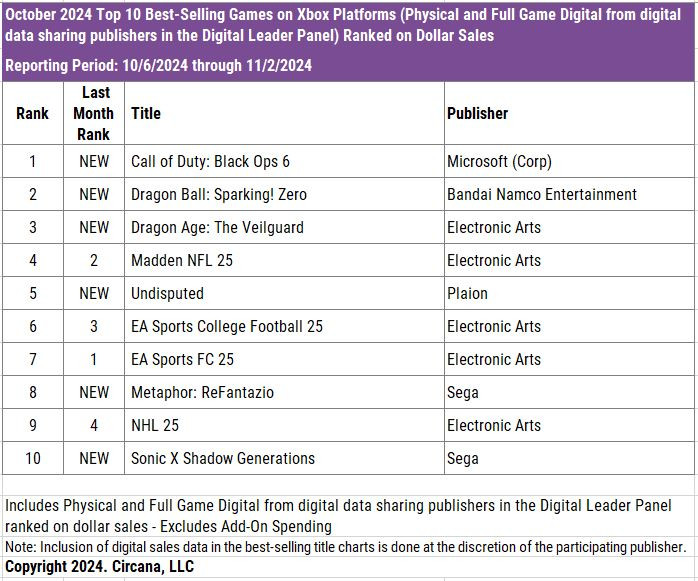

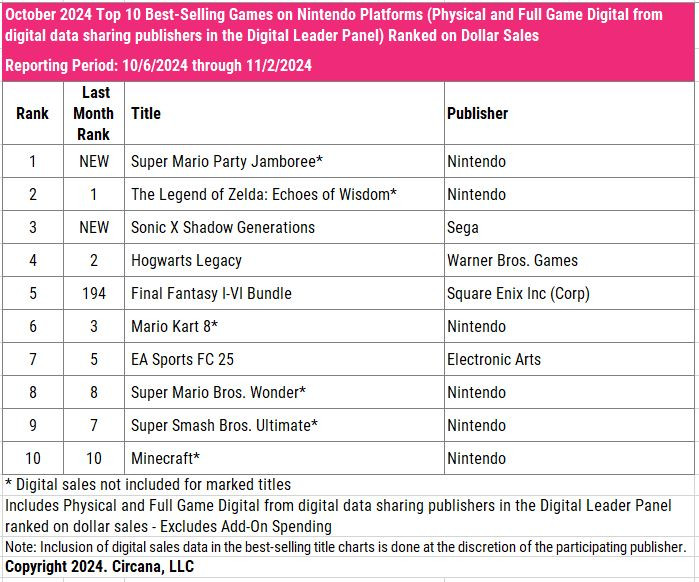

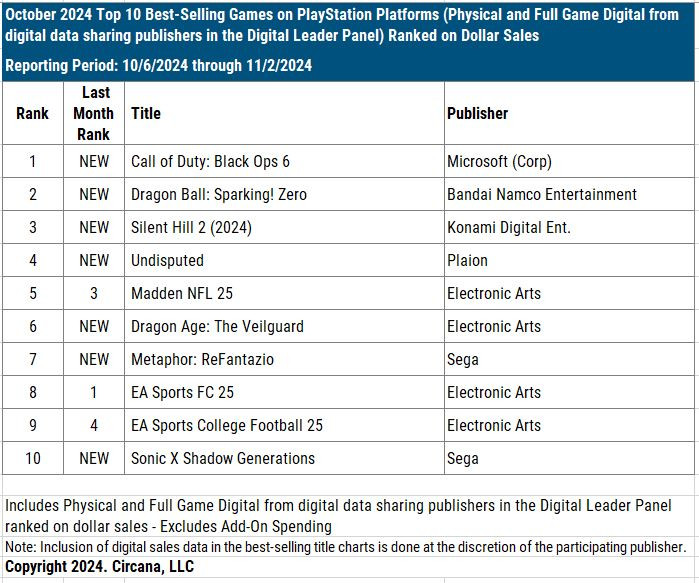

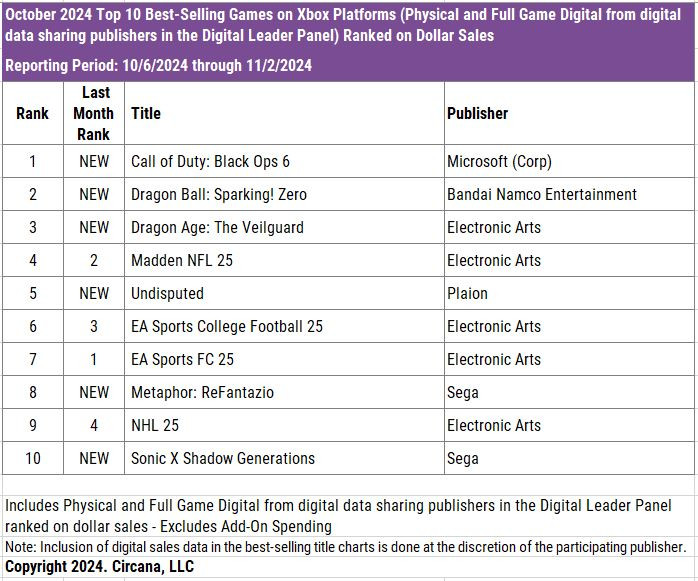

Call of Duty: Black Ops 6 was October’s best-selling video game, debuting as the #3 best-selling game of 2024 YTD. Over each title's first two weeks in market, full game dollar sales of Call of Duty: Black Ops 6 were 23% higher than Call of Duty: Modern Warfare III a year ago. PlayStation platforms accounted for 82% of Call of Duty: Black Ops 6 total console full game dollar sales volume during the October tracking period.

After just one month in market, Dragon Ball: Sparking! Zero became the best-selling Dragon Ball game in U.S. lifetime dollar sales and ranked 3rd among all Bandai Namco Entertainment published titles in history, trailing only Elden Ring and Dark Souls III.

Silent Hill 2 (2024) debuted as the #2 best-selling Silent Hill game in lifetime dollar sales, trailing only the original Silent Hill 2. It ranked 3rd among all video games in October full game dollar sales and at #28 for the 2024 year-to-date period.

Mobile

Sensor Tower: Top 10 mobile games by U.S. consumer spend in October and rank change vs September: MONOPOLY GO!, Royal Match, Roblox, Candy Crush Saga, Last War: Survival, Whiteout Survival, Township, Pokémon GO (+2), Coin Master, and Brawl Stars (-2).

“There was only one major rank change this month, with Pokémon GO (+14%) and Brawl Stars (-19%) swapping places. Brawl Stars is coming off historic highs driven by a groundbreaking collaboration with SpongeBob SquarePants,” said Samuel Aune of Sensor Tower.

“There is a bigger story happening in the background, however: MONOPOLY GO! saw a 20% decline in US revenue this past month. The game earned 50% more revenue in May and June 2024 than it did in October 2024,” said Aune. “Another huge story is the recent release of Pokémon TCG Pocket, which is looking like the launch of the year. The game has already passed the $30M worldwide in-app spend milestone a week after launch, with 22% of that coming from the US (44% coming from Japan)," Aune continued.

Accessories

Consumer spending on Accessories increased 15% in October when compared to a year ago, to $187 million. The PlayStation Portal was October’s best-selling accessory in dollar sales.

Software Charts

Year to Date

Monthly Active User Engagement

Rankings

Units: PS5 > XBS > NSW

Revenue: PS5 > XBS > NSW

InstallBase estimates October 2024

PS5: 290k

XBS: 165K

NSW: 130k

October 2023 for comparison

PS5: 360k

NSW: 210k

XBS: 200K

Thanks Mat Piscatella and Welfare from IB!

Projected October 2024 total U.S. spending on video game hardware, content and accessories grew 10% when compared to a year ago, to $4.7 billion. Year-to-date spending is now 1% above a year ago, at $45.4 billion.

Video game content spending increased by 12% versus a year ago, reaching $4.2 billion. Console content was the biggest contributor to the overall gain, with a spending increase of 27% when compared to a year ago, fueled by console digital full game sales. Non-mobile video game subscription spending increased by 16% when compared to a year ago. The release of Call of Duty: Black Ops 6 as part of Xbox Game Pass was the primary growth driver.

Hardware

Video game hardware spending dropped 23% in October when compared to a year ago. Switch dollar sales fell 38% year-on-year during October, while PS5 declined by 20% and Xbox Series showed an 18% decrease.

PlayStation 5 was once again the best-selling hardware platform in both unit and dollar sales for the month, with Xbox Series ranking 2nd across both measures.

604k units of new video game hardware sold in October 2024 across Arcade, Nintendo Switch, PlayStation 4, PlayStation 5, Plug-N-Play, and Xbox Series platforms. This is down from the 759k units sold a year ago.

Software

Call of Duty: Black Ops 6 was October’s best-selling video game, debuting as the #3 best-selling game of 2024 YTD. Over each title's first two weeks in market, full game dollar sales of Call of Duty: Black Ops 6 were 23% higher than Call of Duty: Modern Warfare III a year ago. PlayStation platforms accounted for 82% of Call of Duty: Black Ops 6 total console full game dollar sales volume during the October tracking period.

After just one month in market, Dragon Ball: Sparking! Zero became the best-selling Dragon Ball game in U.S. lifetime dollar sales and ranked 3rd among all Bandai Namco Entertainment published titles in history, trailing only Elden Ring and Dark Souls III.

Silent Hill 2 (2024) debuted as the #2 best-selling Silent Hill game in lifetime dollar sales, trailing only the original Silent Hill 2. It ranked 3rd among all video games in October full game dollar sales and at #28 for the 2024 year-to-date period.

Mobile

Sensor Tower: Top 10 mobile games by U.S. consumer spend in October and rank change vs September: MONOPOLY GO!, Royal Match, Roblox, Candy Crush Saga, Last War: Survival, Whiteout Survival, Township, Pokémon GO (+2), Coin Master, and Brawl Stars (-2).

“There was only one major rank change this month, with Pokémon GO (+14%) and Brawl Stars (-19%) swapping places. Brawl Stars is coming off historic highs driven by a groundbreaking collaboration with SpongeBob SquarePants,” said Samuel Aune of Sensor Tower.

“There is a bigger story happening in the background, however: MONOPOLY GO! saw a 20% decline in US revenue this past month. The game earned 50% more revenue in May and June 2024 than it did in October 2024,” said Aune. “Another huge story is the recent release of Pokémon TCG Pocket, which is looking like the launch of the year. The game has already passed the $30M worldwide in-app spend milestone a week after launch, with 22% of that coming from the US (44% coming from Japan)," Aune continued.

Accessories

Consumer spending on Accessories increased 15% in October when compared to a year ago, to $187 million. The PlayStation Portal was October’s best-selling accessory in dollar sales.

Software Charts

Year to Date

Monthly Active User Engagement

Rankings

Units: PS5 > XBS > NSW

Revenue: PS5 > XBS > NSW

InstallBase estimates October 2024

PS5: 290k

XBS: 165K

NSW: 130k

October 2023 for comparison

PS5: 360k

NSW: 210k

XBS: 200K

Thanks Mat Piscatella and Welfare from IB!

Last edited: